By Dr. Paschal Ukwu, PhD | Founder, Velien Group

For Legacy-Oriented Leaders & First-Gen Wealth Creators

Artifact: Clean Handoff Map™

CTA: Apply for a Strategic Legacy Briefing™ to map your transfer logic.

A client inherited $25 million from his father. On paper, this should’ve been a smooth transition—lawyers were involved, accountants lined up, documents all neat and notarized. But by the end of that year? The family was in ruins. Two siblings weren’t speaking. One had spiraled into resentment-fueled spending. The patriarch’s legacy? Reduced to legal fees, broken trust, and “What would Dad have wanted?” echoing through the silence.

The problem wasn’t a lack of planning—it was a lack of clarity.

Here’s the thing: Most of us didn’t grow up with wealth. We didn’t sit at dinner tables where transfer strategy or legacy design were household topics. And when we do start building real capital, no one hands us the playbook for how to pass it on without accidentally lighting the house on fire.

That’s where we come in.

At Velien Group™, we don’t manage portfolios. We design what we call transfer logic—a structure that doesn’t just move money from one generation to the next, but preserves the intelligence behind it. The values. The decision rhythm. The ability to wield wealth without being wounded by it.

You’ll see that phrase show up a lot around here: transfer logic. Not just estate planning. Not just tax minimization. This is a strategy—built on human behavior, emotional nuance, and power dynamics that most families pretend don’t exist until it’s too late.

“We don’t manage money—we architect transfer logic.”

This isn’t theory. It’s field-tested. And over the next few sections, we’re going to walk you through a way of thinking about wealth transfer that doesn’t end in conflict, entitlement, or quiet regret.

Let’s dig in.

Contents

- 1 The Silent Collapse: Why Most Transfers Fail

- 2 Entitlement, Ambiguity, and Emotional Landmines

- 3 Step-by-Step Guide: Building a No-Drama Wealth Transfer

- 4 Download This: 5-Step Transfer Logic Checklist

- 5 Optional: Try the Transfer Logic Readiness Score™

- 6 The Artifact: What’s in the Clean Handoff Map™

- 7 Myth-Busting FAQ: What Most Get Wrong About Legacy Transfers

- 8 📘 Want to Go Deeper?

- 9 Ready for the Strategic Legacy Briefing™?

- 10 🎁 Why It’s Private

- 11 🔒 Want Access?

- 12 About Dr. Paschal & Velien Group™

The Silent Collapse: Why Most Transfers Fail

Wealth transfer is supposed to be a blessing. But for too many families, it turns into a slow-motion implosion they never saw coming.

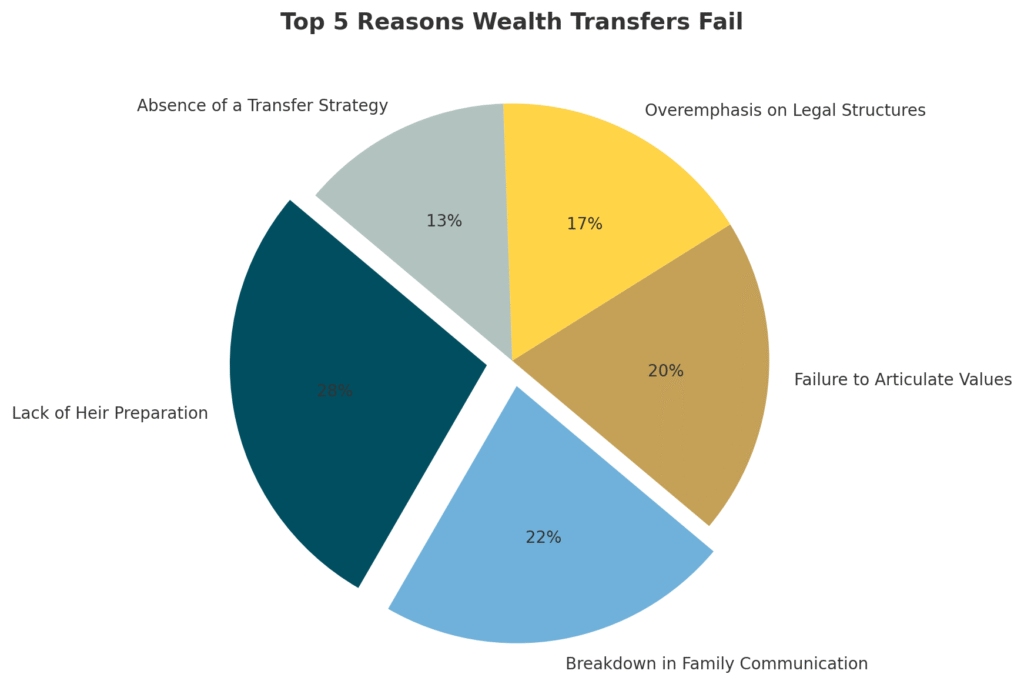

Here’s the stat that still haunts me, even after seeing it play out firsthand: 70% of wealth transfers fail to preserve family continuity. That’s from Cerulli Associates. Not a typo. Not a scare tactic. Just a cold truth.

And when failure happens, it doesn’t look like a bank account suddenly draining. It’s quieter than that. Slower. Sometimes, the cracks show up in courtrooms—siblings lawyered up, fighting over “what Mom really wanted.” Sometimes it’s in holiday dinners that just… stop happening. Or in an heir who’s so overwhelmed they freeze, fumble, or burn through the money trying to prove they’re worth it.

I’ve seen a family business handed down with all the right tax wrappers and trusts… but no real understanding of how to lead. The next generation was unprepared, misaligned, and, frankly, in over their heads. Within three years, the company was sold under duress, and the relationships went with it.

And then there’s the quiet killer: entitlement. The moment wealth is expected—not earned, not respected—it turns corrosive. One heir starts acting like a CEO without ever earning the title. Another checks out entirely, assuming they’ll be “taken care of.” That’s not a legacy. That’s a time bomb.

What’s most heartbreaking? No one sees it coming until the will is read. Families think they’ve done everything right—because the paperwork is in order. But documents don’t make decisions. People do. And when those people aren’t ready, or don’t know how the system works, everything you built can unravel in an instant.

Dr. James Grubman, a pioneer in family wealth psychology, puts it this way:

“Inheriting wealth is not an event—it’s a developmental process. Without preparation, it becomes a crisis.”

We couldn’t agree more.

This is why we don’t start with asset classes or trust structures. We start with logic—transfer logic. Because the moment you’ve built something worth protecting… the real work begins.

Entitlement, Ambiguity, and Emotional Landmines

Let’s be honest—no one thinks their family will be that family. The one that ends up in a three-year probate war or has siblings fighting over mom’s vacation house in Maine. But it happens. All. The. Time.

And the worst part? It’s rarely about the money.

It’s about what wasn’t said. What wasn’t made clear. What roles weren’t defined? That’s where the real breakdown begins—not in court, but around dinner tables that suddenly go quiet.

Here’s the trap: most wealth creators think if the legal docs are airtight, they’ve done their job. A trust, a will, a few clauses, maybe a corporate structure for good measure. But the legal structure ≠ transfer strategy. Paperwork doesn’t prepare people.

The Real Gaps No One Talks About:

- You named them a beneficiary—but did you prepare them to be a steward?

- You picked a trustee—but who’s walking them through the real-life mess of family politics?

- You built an empire—but have you mapped the emotional terrain that comes with it?

Here’s the reality: when control and benefit aren’t clearly separated, confusion brews. The kids think, “I’m in the trust, so I get to decide.” Not quite. And when everyone assumes someone else is ‘handling it’—no one really is.

“It’s not the money that breaks families. It’s the silence.”

— Someone who’s seen it up close (too many times)

Step-by-Step Guide: Building a No-Drama Wealth Transfer

How to architect calm, clarity, and control across generations.

Even with the best frameworks, execution is where families stumble. It’s not just about preparing documents—it’s about preparing people. A successful transfer is built with rhythm, not reaction. Below is a distilled guide we use inside Velien Group’s Private Wealth Briefings™ to ensure high-income families build a repeatable, respected, and drama-resistant transfer system.

The 5 Essential Components of a Smooth Wealth Transfer

Role Alignment: Owner → Controller → Beneficiary

Start by defining who does what—not just now, but across time.

Too many families skip this step, assuming titles like “trustee” or “executor” explain enough. They don’t.

| Role | Definition | Common Mistake |

|---|---|---|

| Owner | Holds assets today | Assumes their will ensures harmony |

| Controller | Executes authority over timing & access | Poorly trained or emotionally reactive |

| Beneficiary | Receives value (not always at once) | Equates inheritance with entitlement |

Tip: Document responsibilities before documents. Clarity of role beats formality of paperwork.

The Pre-Briefing Family Agenda

Don’t wait for the funeral to explain your thinking.

Use this sample agenda to initiate open, values-based conversations while you’re alive and lucid:

Sample Agenda: “Legacy Without Landmines”

- Why we’re doing this (vision)

- What the structure looks like (overview, not legalese)

- What you’re each responsible for (role clarity)

- How decisions will be made (tie-breakers, advisors, authority)

- What to do when conflict arises (emotional governance)

“This isn’t just about money—it’s about what this money should make possible. I want to make sure each of you is not just informed, but equipped.”

Guardrails & Decision Logic

No plan survives contact with real life—unless you build in intelligent friction.

Use Decision Guardrails to prevent paralysis or power grabs:

- Tie-breaker protocols (ex: 2 out of 3 trustee votes)

- Trustee rotation limits (ex: 4-year terms)

- Red flag triggers (ex: cognitive decline, divorce, lawsuits)

This ensures control doesn’t bottleneck or shift into chaos when unexpected events arise.

Life-Cycle Event Triggers

Instead of transferring assets on death, consider milestones:

| Event Trigger | Access Granted |

|---|---|

| Age 30 | Financial literacy certificate required |

| Marriage | Prenup review & briefing mandatory |

| First child born | Heir assigned guardianship preferences |

| New business launch | Seed capital released via approval board |

This keeps the transfer alive—tied to behavior, not just biology.

Annual Legacy Briefing Structure

Set a ritual. Create a rhythm. High-performing families run like businesses.

Each year, hold a Legacy Briefing that includes:

Slide Deck Flow (just 5 slides):

- Family Vision Statement

- Overview of Legacy Assets

- Roles & Updates (any handoff status)

- Questions & Concerns

- Next Steps / Education Plan

📆 Calendar Tip: Do it around a holiday dinner or birthday weekend—tie it to memory, not just money.

Download This: 5-Step Transfer Logic Checklist

This checklist includes:

- Role definitions

- Briefing questions

- Guardrail templates

- Trigger planning prompts

- Sample slides for your Legacy Briefing

Perfect for advisors, family office leads, or founders.

Optional: Try the Transfer Logic Readiness Score™

Want to know where your family stands today?

Try our Transfer Logic Readiness Score™ – a simple 7-question self-assessment that reveals how prepared your family is to transfer power, not just assets.

→ [Coming soon]

Let me know if you’d like me to generate the PDF download, click-to-copy scripts, or score tool mockup next.

When you’re ready, I’ll write Section Six: “The New Stewardship: From Entitlement to Agency”—or we can prep the Canva visuals to publish this full post as a blog article + downloadable toolkit.

The Artifact: What’s in the Clean Handoff Map™

Transferring wealth isn’t just about writing a will. It’s about engineering clarity.

And that’s where the Clean Handoff Map™ comes in — a proprietary artifact designed for families and founders who can’t afford ambiguity, delay, or drama.

This isn’t a generic estate binder or asset worksheet. It’s a precision-built continuity blueprint that answers one question:

If something happens to me tomorrow, can my capital, control, and continuity hand off seamlessly — without chaos or conflict?

What’s Inside the Clean Handoff Map™

This isn’t a static document — it’s a living system. Each Map includes:

- Role Architecture – Clear definition of who does what when legacy decisions are triggered (Trustee, Executor, Operator, Legal Liaison, etc.)

- Event Timeline Grid – A visual chain of execution steps, aligned with real-world timing (Immediate – 72H – 30D – 90D – Long-Term).

- Trigger Protocols – What activates a handoff? (e.g., health event, leadership incapacity, death, capital unlock)

- Logic Design & Contingency Flow – A scenario matrix for how decisions adjust based on conditions — not legalese, but operational logic.

- Continuity Council™ Overlay – Optional layer for implementing governance teams and neutral decision adjudication.

Each section is modular — built to adapt to family complexity, business ownership, and philanthropic goals.

Who It’s For

This isn’t for those just getting started. It’s built for those who already have something to lose.

- $5M+ estates seeking clarity across multi-generational lines

- Family offices coordinating across trusts, operators, and advisors

- Busy founders who want operational clarity if they’re not present tomorrow

- Portfolio builders managing properties, assets, equity, or complex holdings

If your life’s work is a mosaic of investments, decisions, and people — this Map ensures every piece fits when it matters most.

Why It’s Essential

“If you want to do this right… you need a map, not just a will.”

Wills are static. Trusts are legal. But wealth?

Wealth is alive. It moves, mutates, and sometimes murders relationships without clarity.

The Clean Handoff Map™ was built to do what traditional planning misses:

- Prevent turf wars

- Eliminate guesswork

- Build decision muscle for the next generation

- Make sure your exit doesn’t feel like abandonment

No more binders on a shelf. This is your continuity operating system.

Sample Agenda & Governance Flow Preview

Here’s a peek at the neutral continuity governance structure:

| Step | Phase | Governance Flow |

|---|---|---|

| 1 | Trigger Event (e.g., incapacity) | Legal Liaison initiates notification protocol |

| 2 | 72-Hour Review | Continuity Council™ meets to verify intent & transition |

| 3 | 30-Day Execution | Financial operators begin liquidity sequence & role reassignments |

| 4 | 90-Day Audit | Governance report distributed; philanthropic and capital directives executed |

This sample agenda is shared only during live briefings.

🔒 Access the Full Map

This artifact is not publicly available. To preserve its integrity and ensure it’s delivered with context, we only provide access through our private Strategic Briefing™.

🎯 Want access to the full Clean Handoff Map™?

You’ll get it — after we ensure it’s the right fit for your continuity profile.

👉 [Download Available via Strategic Briefing™]

(Limited seats. Next session: by invitation only.)

Myth-Busting FAQ: What Most Get Wrong About Legacy Transfers

To help you move beyond traditional estate planning and into true generational strategy, we’ve addressed some of the most common misconceptions below.

“Isn’t this just estate planning?”

No — and that’s the problem. Traditional estate planning is about dividing assets. Strategic handoffs are about transferring decision power, clarity, and leadership capacity. This map includes roles, logic, timing, and human dynamics — all the things estate documents overlook.

Estate plans divide assets. Clean Handoffs transfer legacy.

“Can my CPA or lawyer do this?”

They can help — but they’re not trained in interpersonal transitions, family dynamics, or legacy sequencing. This isn’t just legal; it’s architectural. CPAs focus on tax. Lawyers focus on compliance. This map focuses on strategic continuity.

✅ We work alongside your legal team, not in place of them.

“How do I prepare my kids without making them entitled?”

This is the core of the Heir Readiness Sprint™. We help you instill agency, stewardship, and vision ownership in the next generation—without triggering entitlement. Think: leadership training, not inheritance talks.

“What if there’s conflict between heirs?”

There often is. That’s why we design neutral decision protocols and logic maps to resolve disputes before they escalate. This isn’t reactive mediation — it’s proactive governance design.

🧭 Families don’t fall apart from money. They fall apart from a lack of clarity.

“Can’t I just create a trust and call it a day?”

You can, but you’ll be leaving strategy to chance. Trusts protect assets — they don’t empower heirs or guide transitions. Our Clean Handoff Map™ bridges that gap with clarity, flowcharts, and role assignment.

🔒 A trust is protection. A map is direction.

📘 Want to Go Deeper?

Explore our next-level training:

→ Heir Readiness Sprint™ – Our Next Module

Ready for the Strategic Legacy Briefing™?

This isn’t a webinar.

This is your private session to design the future of your estate beyond documents.

🎯 Who It’s For

- Founders, operators, and professionals managing or planning $5M+ wealth transitions

- Families preparing for multi-generational stewardship

- Executives seeking clarity beyond legal and tax checkboxes

🧾 What’s Included

✔️ Clean Handoff Map™ — Your master visual for sequencing roles, timelines, and transfer logic

✔️ Briefing Deck Template — Pre-structured to share with your advisors or heirs

✔️ Governance Flow Planning — Conflict-resolution logic embedded in your continuity

🔒 Note: This is not publicly available. To preserve its impact, access is granted through a short application and strategic fit review.

🎁 Why It’s Private

Because most families don’t fail from poor intentions —

They fail from unclear transitions.

This briefing is not about theory. It’s about designing the actual architecture of legacy — together, privately, and with context.

🧭 Success Path: From Wealth Earner → Strategic Architect

[Icon: 💼] Wealth Creator

↓

[Icon: 🧭] Strategic Briefing™

↓

[Icon: 🧠] Clarity on Roles & Triggers

↓

[Icon: 📜] Clean Handoff Map™ Finalized

↓

[Icon: 🏛️] Multi-Generational Continuity Begins

🔒 Want Access?

This is a high-impact 45-minute session for decision-makers only.

Limited to 15 seats per round.

Apply below to request a spot. If accepted, your Clean Handoff Map™ is included.

(Anchor this section on your page + create sticky CTA button in header/footer.)

About Dr. Paschal & Velien Group™

Dr. Paschal Ukwu, PhD — Founder, Velien Group™ | Strategic Legacy Architect

🧑⚖️ Dr. Paschal Ukwu

Dr. Paschal is a PhD-level clinician, executive strategist, and legacy systems architect serving high-income families, founders, and professionals across North America. With over a decade of experience bridging behavioral insight, capital planning, and human continuity, his work sits at the intersection of wealth, psychology, and future design.

As the creator of The Clean Handoff Map™, Dr. Paschal helps families design transitions that outlast titles, trustees, and time. His private briefings are trusted by multi-generational families navigating $5M+ transitions with complexity, conflict, or future uncertainty.

📍 Connect with Dr. Paschal:

🔗 LinkedIn Profile

📺 [Media Features – Coming Soon]

🏛️ About Velien Group™

Velien Group™ is a strategic design firm specializing in intergenerational continuity, capital transfer choreography, and executive clarity systems. We don’t manage your assets.

We engineer your legacy strategy.™

Our clients include:

- Founders transitioning control without creating chaos

- Families preparing heirs for long-term stewardship

- Executives aligning legacy goals with real-world transfer logistics

Every engagement is context-rich, advisor-aligned, and psychology-aware — because a perfect trust structure means nothing if the people behind it aren’t ready.